How Much Is Geico Car Insurance: Cost, Rates & Quote Can Be Fun For Anyone

cheap car vans cheap car laws

Crashes, cases, as well as tickets will constantly enhance your costs. For the biggest rates, drive safely and also stay clear of getting captured with a ticket. The age and also gender of the chauffeur also contribute to determining the insurance prices. Teenager chauffeurs have greater rates, as they are thought about to have higher chances of entering a mishap and are likely to submit a case.

The auto you drive will certainly have an effect on your insurance policy costs, as it constantly has. Why do automobile insurance coverage costs vary by state? Auto insurance policy varies by state for a few reasons. cheaper cars. One is that each state has its very own insurance coverage regulations. These legislations mandate the minimum cars and truck insurance policy coverages as well as limits an automobile owner should continue their car.

Nevertheless, our study tried to make it even more of an apples-to-apples contrast by checking out the exact same amount of coverage of liability in each state (100/300/50), having uninsured driver of 100/300 plus comp and accident coverages. This after that highlights the extras some states require that push prices higher, like the PIP demands in Michigan and Florida.

State laws likewise lead insurance policy firms on what they can and also can not rate motorists on which affects prices (cheaper car). While all states permit specific danger factors to be checked out, such as your driving record, there are some aspects that some states have banned, such as credit rating score, gender and age.

What states have the least expensive automobile insurance coverage prices? Most of the states with the lowest automobile insurance rates are smaller as well as much less inhabited.

The 10-Second Trick For How To Avoid Overpaying For Car Insurance - Consumer Reports

The states pointed out listed below have the cheapest vehicle insurance prices: Maine New Hampshire Wisconsin Just how to lower cars and truck insurance coverage prices? You can not constantly control every element that affects your vehicle insurance rates, however there are things you might do to conserve cash. Maintaining automobile insurance policy prices reduced by improving your driving practices and credit report, seeking discounts, as well as making use of usage-based insurance (pay per mile) are all options.

If you do not drive a lot, choose for pay-per-mile insurance coverage. Conserve cash on vehicle insurance coverage rates in any kind of state No matter of where you live, discovering cheaper insurance policy is constantly a winning technique.

They are going shopping with at the very least 3 insurance firms for insurance coverage and rates, raising the deductible, using usage-based insurance coverage, and also applying all the available discount rates. This is commonly the very best method to decrease your costs. Insurers rate risk in a different way, so there can be dramatic distinctions in premium quotes. Store at the very least three insurers and always make certain you're contrasting apples to apples when it pertains to coverage degrees and also deductibles (credit).

Any life event is a great factor to search searching for a better bargain on auto insurance. cheap auto insurance. "Constantly look around when there is a life event that would spark rate adjustments," encourages Gusner. "This could be a wedding event, a teen going on your policy, adding a vehicle, doing away with a cars and truck and even needing to submit a claim on your policy.

Talk to your insurance firm or agent to ensure all offered discount rates are being put on your policy. Increasing your insurance deductible can be a terrific means to lower your costs if you can manage it. Constantly select a deductible that you can conveniently pay for in case you have to make a claim - cheap.

Indicators on Average Cost Of Car Insurance (2022) - Valuepenguin You Should Know

The price consists of uninsured motorist insurance coverage. Actual prices will certainly depend on specific motorist variables. We averaged prices in each state for the cheapest-to-insure 2021 model-year variations of America's 20 very popular vehicles as of Jan. 2021 and rated each state by that standard. Prices are for comparative objectives just within the exact same design year.

The NAIC's numbers show the ordinary amount that specify residents invest for car insurance policy, no matter of the kind of car they insure or amount of coverage they buy. Often asked concerns What states have the cheapest auto insurance policy rates? Our study reveals that the top 5 least expensive states for automobile insurance coverage in 2021 are: Maine, New Hampshire, Wisconsin, Idaho, Ohio Cheaper specifies for car insurance tend to have lower populace thickness and an open market for automobile insurance.

What states have no vehicle insurance policy? A couple of states do not directly claim in their legislations you must acquire car insurance, New Hampshire, Tennessee and Virginia are the primary ones; nevertheless, all states need you to have methods for financial obligation if you are in a crash. The most convenient way to show monetary obligation is with a vehicle insurance coverage (business insurance).

On the other hand, to obtain a car insurance coverage, you can simply contrast store online, find the very best plan for your requirements as well as buy it. What are the factors that impact the automobile insurance costs? As we discussed earlier, car insurance provider check out a selection of threat elements when identifying your rates.

How moving to a various state might impact your car insurance costs? Location matters to vehicle insurance coverage companies, so if you relocate throughout the state or to a brand-new state, be prepared for your premiums to alter.

The Buzz on Average Car Insurance Rates By Age And State (June 2022)

Higher claims in that location will result in higher prices. Keep in mind to cars and truck insurance coverage contrast shop with at least three firms to discover out who in your area gives the ideal prices.

While vehicle insurance rates are vital, they pale compared to the threat of losing a kid. Teens as well as young grownups have the least expensive seat belt use rates of all chauffeurs, a fact that enhances their threat of injury if an accident happens.

In 2019, of the 15- to 20-year-olds who died in cars and truck crashes, 24% had a blood alcohol concentration (BAC) of 0. 01 or higher, and 82% of those motorists had a BAC of 0. 08 or more. There is no refuting that automobile insurance policy for an 18-year-old is costly. Whether or not a parent chooses to keep their child on their insurance policy, parents should go over these risk factors with their young drivers.

/how-much-does-car-insurance-cost-5072100_final-915c31d331c9435085f258da3e1e1852.png)

cheap insurance vehicle insurance insure vehicle

In 2019, 71% of all vehicle crash fatalities were male. Still, it does not always apply that guys pay more for automobile insurance coverage than ladies. While young males pay substantially greater than young female motorists because of the analytical odds of a man being associated with a crash, males either pay the very same rate as ladies or a little much less by the time they have actually struck middle age - car insurance.

Delta Dental: Affordable Dental Insurance Plans Things To Know Before You Get This

The reason women wind up paying extra at any factor is unidentified. Some states have actually started to take actions to get rid of sex as a rate factor to consider. Unless there is an analytical factor to think one gender is included in even more crashes than the other, it makes no sense to charge one more.

When we contrasted the average price to guarantee a 35-year-old female against the expense to guarantee a 35-year-old man, there was only a $26-a-year distinction, with women paying slightly much less. Offered the sheer variety of good vehicle insurance firms included in our evaluation, $26 each year (or $2. 16 per month) might be as close to also as is sensible to anticipate.

Average cars and truck insurance rates by age and also sex, As the cars and truck insurance policy prices by age chart showed, young chauffeurs pay even more for insurance policy than older motorists with clean driving documents. What's intriguing is just how different combinations of circumstances impact rates. How do the prices of a young vehicle driver with a tidy driving record contrast to the rates of a middle-aged motorist with a crash on their document? Here, we'll look at the ordinary national prices for different age and sex combinations.

The average yearly price of car insurance policy in the united state was $1,057 in 2018, according to the most recent data available in a record from the National Association of Insurance Policy Commissioners. However, understanding that figure will not necessarily help you determine just how much you will certainly be spending for your very own insurance coverage.

To better understand what you should be paying for automobile insurance policy, it's best to discover regarding the method business establish their prices. Keep reading for a summary of the most usual factors, and just how you can make a couple of extra financial savings. Determining Ordinary Annual Auto Insurance Policy Price There are a whole lot of elements that go right into determining your auto insurance coverage price.

The Ultimate Guide To How Much Does Car Insurance Cost? - Experian

Crash Background, Your recent accident history influences insurance coverage prices. If you have not had a recent crash, you can expect lower ratesassuming all various other score variables are equal. From an insurance provider's viewpoint, everybody is risky, however they aren't fairly sure how dangerous we are. Until we have an accident, that is.

Crashes can lead to greater rates for three to five years. Area, Where you live can affect auto insurance policy rates.

In this situation, insurance firms are taking a look at website traffic thickness as well as various other risks such as burglary and also criminal damage. Instead than examining where you drive, insurance firms generally think about garaging area, with the presumption that much of your driving will certainly be close to where you park your auto at evening (insurance companies).

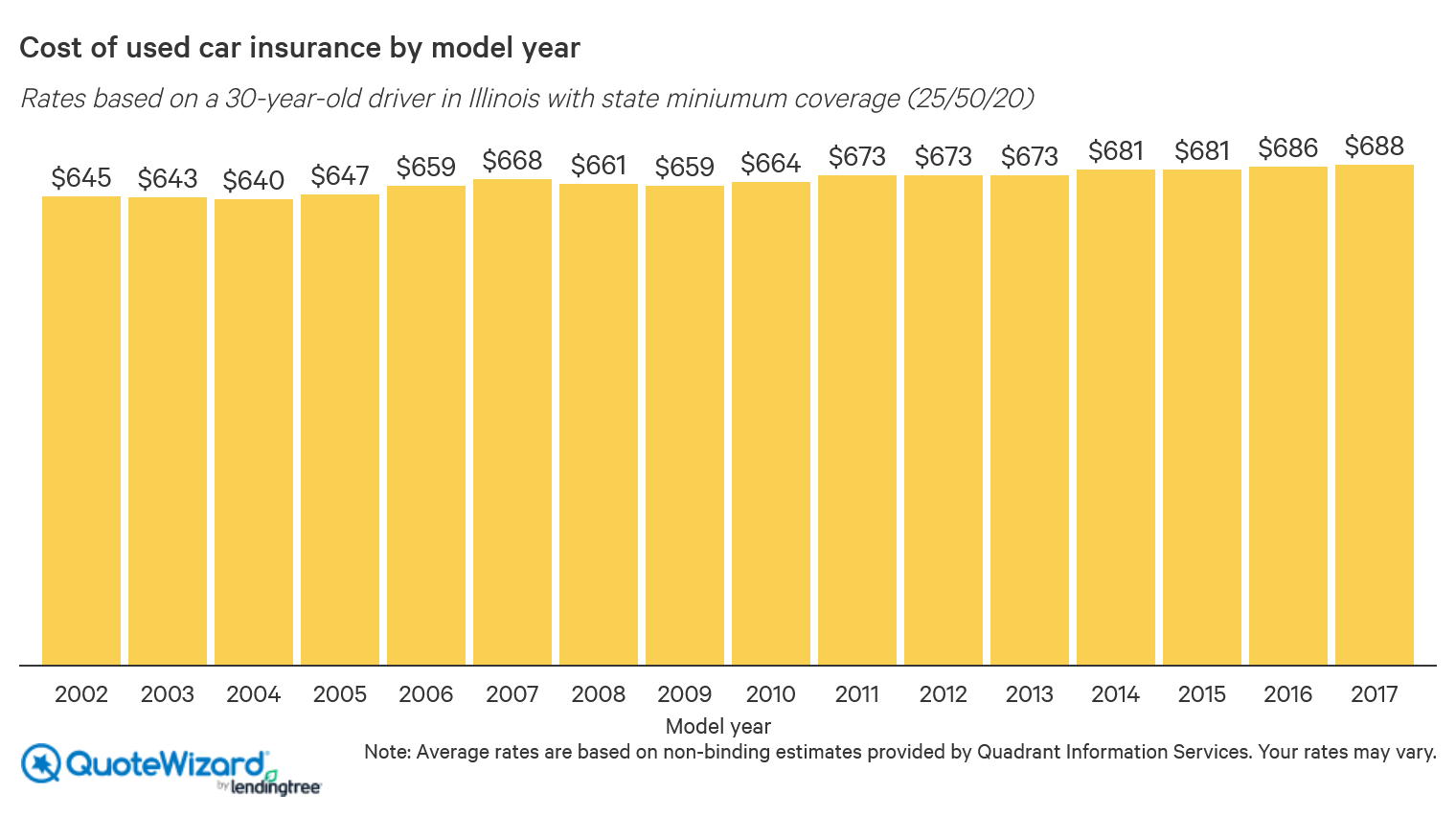

Age as well as Worth of the Car, In AAA's research, the motorists guaranteed a 2021 model year car. Newer cars can set you back even more to insure due to the fact that they are worth more. Nonetheless, often safety and security features readily available on newer vehicles can help counter the cost of guaranteeing an extra useful car. Some insurance firms also supply a new-car discount rate.

insurance affordable car insurance cars car insured

Lots of houses have cars of different ages, often with various insurance policy demands. As an example, if you have an older lorry that's settled, you might not need to lug physical damages coverage. The National Association of Insurance Coverage Commissioners (NAIC) additionally puts out a report on vehicle insurance policy costs, damaging out the expense by state and also insurance policy type.

Compare Cheap Car Insurance Quotes - Gocompare Things To Know Before You Buy

Both insurance coverage and insurance coverage offer security for physical damage to your own automobile. The premium refers to complete insurance coverage, that includes called for responsibility insurance coverage as well as physical damage insurance coverage. Some states need medical insurance coverage, also. Over a lots states also require uninsured/underinsured driver security. refers to the ordinary amount insured drivers pay.

cheapest car affordable money cheap car insurance

See all 6 images, What Other Elements Affect Auto Insurance Policy Rates? Car insurance prices take into consideration even more than just your driving history.

insurance affordable perks cheapest auto insurance cheaper

Before you take a pruning shear to your plan restrictions, take into consideration other factors that can affect your insurance coverage costs. In the long run, your protection restrictions protect you and also your household, so greater limitations can be a wiser choice for some. Below are some workable elements that can affect automobile insurance prices.

If your credit report might utilize a tune-up, taking steps to enhance your credit report can result in insurance financial savings, as well - insurers. Moving offenses can finish up setting you back even more than just the expense of the penalty. Tickets for moving violations can create you to lose a secure driving price cut and even lead to an additional charge that can last for several years.

Before driving residence in a car you dropped in love with at the dealer, research study the cost for insurance. In some cases you'll earn much better prices if you have actually had constant coverage for three years or longer.

The What Is The Average Car Insurance Cost Per Month? - The ... PDFs

Take steps to be certain coverage doesn't gap and when altering insurers don't cancel the old policy till after the effective date and time for the brand-new policy (trucks). See all 6 images, Just how to Get Coverage for a 16-Year-Old Chauffeur, Car insurance coverage costs can transform substantially if you have a young vehicle driver in your family.

Nevertheless, that has the auto likewise plays a function. If you possess the vehicle, the policy needs to be in your name. If your teenager chauffeur owns the automobile, the insurance requires to go in their name. If both names get on the title, you have some adaptability and can guarantee the automobile in either name.

https://www.youtube.com/embed/p_3A6dWZOjU

Young motorists away at college can reduce coverage if the automobile stays at home as well as the institution is much sufficient away (usually 100 miles). Numerous states supply driver's education for pupils. Price cuts for vehicle driver's education and learning are usual. Separate from a vehicle driver's education and learning price cut, several insurance companies additionally provide a discount for completing an approved protective driving course.